Volunteer Income Tax Assistance (VITA)

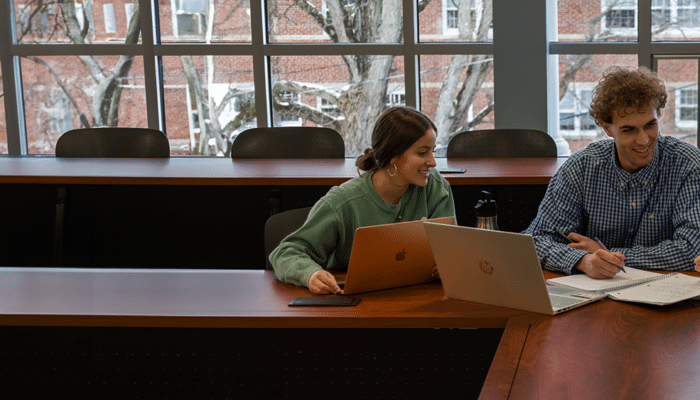

Welcome to our Volunteer Income Tax Assistance (VITA) services page. At Nichols College, we’re here to offer free tax help to those in our community whose gross income is $60,000 or less. Our team of dedicated student volunteers is ready to assist you in navigating tax season with ease. Whether you’re filing for the first time or seeking guidance on deductions and credits, we’re here to simplify the process and ensure you get the maximum refund you deserve. Explore how our VITA services can support you through tax season.

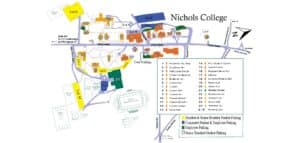

Hours and Location

Tuesday & Thursday

5pm – 7pm

Currier Center

Live and Virtual Appointments

Saturday

9am – 12pm

Currier Center

Live and Virtual Appointments

To schedule an appointment or to request an appointment at other times, please contact:

Phone: 508-213-2260

Email: vita@nichols.edu

Will Prepare

- Wages, salaries, etc. (Form W-2)

- Interest Income (Form 1099-INT)

- Dividends Received (Form 1099-DIV)

- State Tax Refunds (Form 1099-G)

- Unemployment Benefits (Form 1099-G)

- IRA Distributions (Form 1099-R)

- Pension Income (Forms 1099-R, RRB-1099-R, CSA-1099)

- Social Security Benefits (Form SSA-1099, RRB-1099)

- Simple Capital Gain/Loss (Form 1099-B) limited

- Sale of Home (Form 1099-S) limited Prior Year and Amended Returns

- Self-Employed Income (Form 1099-MISC, Form 1099-NEC and Form 1099-K) limited

- Gambling Winnings (Form W-2G)

- Cancellation of Debt (Form 1099-C) limited

- Health Savings Accounts (Form 1099-SA) limited

- Itemized Deductions limited

- Education Credits (Form 1098-T)

- Child Tax Credit

- Earned Income Credit

- Health Insurance Statements (Forms 1095-A, B or C)

Will Not Prepare

- Schedule C with loss, depreciation or business use of home

- Complicated Schedule D (capital gains and losses)

- Form SS-5 (request for Social Security Number)

- Form 8606 (non-deductible IRA)

- Form 8814 (child taxed at parent’s tax rate)

- Form SS-8 (determination of worker status for purposes of federal employment taxes and income tax withholding)

- Parts 4 & 5 of Form 8962 (Allocation of Policy Amounts, Alternative Calculation for Year of Marriage)Form W-7 (application for Individual Taxpayer Identification Number (ITIN) )

- Returns with casualty/disaster losses

What to Bring

- For married filing joint, both spouses must be present

- Government issued photo identification for you and your spouse (if married)

- Social Security cards or Individual Taxpayer Identification Number documents for you, your spouse, and/or dependents

- Birth dates for you, spouse, and/or dependents

- A copy of last year’s tax return

- All Forms W-2 and 1099

- Forms 1095-A, B or C (ACA Statements)Information for other income

- Information for all deductions (including charitable contributions)/credits

- Total paid to day care provider and their tax ID number

- For direct deposit of refund, proof of account and bank’s routing number

- For prior year returns, copies of income transcripts from IRS (and state, if applicable)

Volunteer

Volunteer with VITA and earn Continuing Education Credits while making a meaningful impact in your community! Help individuals and families access important tax services while advancing your professional development. Apply now to join our team and be a part of a rewarding experience this tax season! Note: Volunteers are required to have an accounting degree or relevant tax preparation experience. To volunteer contact Michael Forte at vita@nichols.edu or 508-213-2260.